Diminishing value method of depreciation formula

If you use this method you must enter a fixed. 1 Scrap ValueAsset Value 1Life Span In.

Written Down Value Method Of Depreciation Calculation

Use the following steps to calculate monthly straight-line depreciation.

. The diminishing balance method is a method of calculating the depreciation expense of an asset for each accounting period. For the second year the depreciation charge will be made on the diminished value ie Rs 90000 and it will be 90000 10 R s 9000 Now the value of the. As the book value reduces every.

And the residual value is. Now lets work through a diminishing value calculation. The double declining balance depreciation method is one of two common methods a business uses to account for the.

Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. Hereof How do you calculate diminished value depreciation. Diminishing Value Depreciation Method.

The two methods can. You might need this in your mathematics class when youre looking at geometric s. The formula for prime.

Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. Diminishing Balance Depreciation is the method of depreciating a fixed percentage on the book value of the asset each accounting year until it reaches the scrap value. Written down value method or reducing installment method does not suit the case of lease whose value has to be reduced to zero.

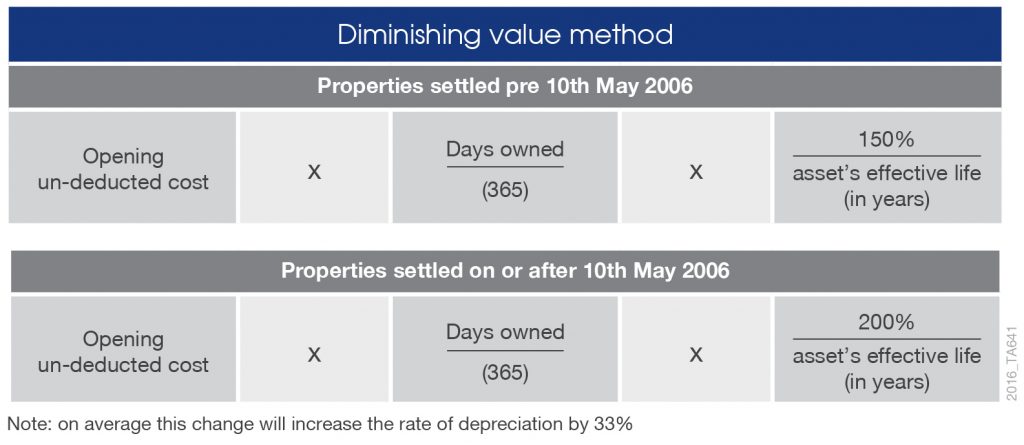

On 1st January 1994 a merchant purchased. Diminishing value method Another common method of depreciation is the diminishing value method. Base value x days held 365 x 200 assets effective life.

Subtract the assets salvage value from its cost to determine the amount that can be depreciated. The diminishing value formula is as follows. In this video we use the diminishing value method to calculate depreciation.

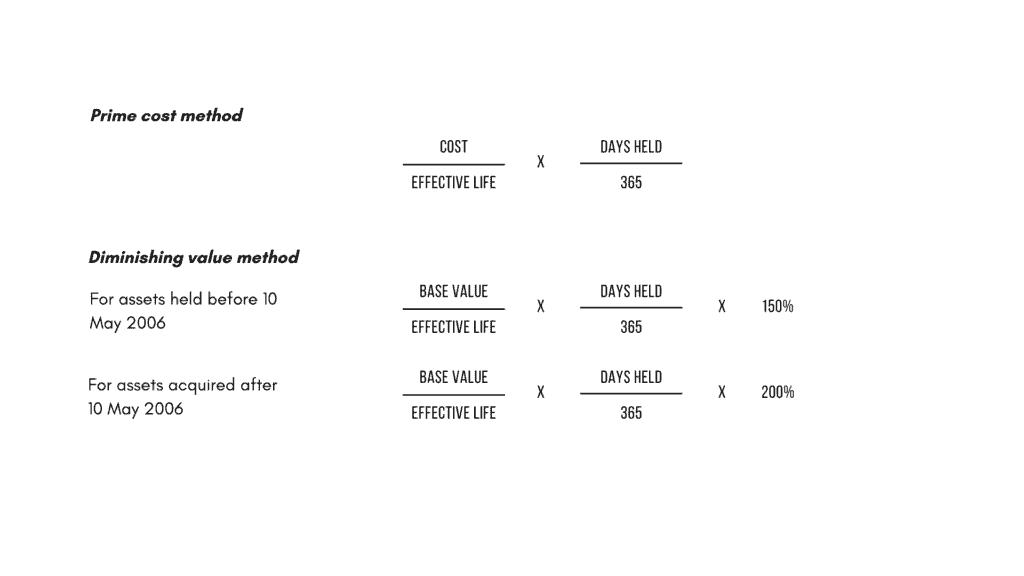

Under the prime cost method also known as the straight-line method you claim a fixed amount each year based on the following formula. Prime cost straight line method. Double Declining Balance Depreciation Method.

Diminishing Balance Method Example. According to the Diminishing Balance Method depreciation is charged at a fixed percentage on the book value of the asset. Assets cost x days held.

A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years. Cost value 10000 DV rate 30 3000. This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following formula.

Year 2 2000 400 1600 x. Base value days held 365 150 assets effective life Reduction for. 2000 - 500 x 30 percent 450.

As it uses the reducing. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. The diminishing balance method of depreciation or as it is also known the reducing balance method calculates depreciation as a percentage of the diminishing value of.

This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime. The diminishing balance method is a. If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this.

Meanwhile the diminishing value depreciation method will permit for an increased depreciation deduction in the initial few years of property ownership. Year 1 2000 x 20 400.

Written Down Value Method Of Depreciation Calculation

Solved I M Trying To Calculate For The Diminishing Rate On Chegg Com

Declining Balance Method Of Depreciation Formula Depreciation Guru

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

Accounting Practices 501 Chapter 9 Ppt Video Online Download

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

How To Use The Excel Db Function Exceljet

Depreciation Diminishing Balance Method Youtube

Written Down Value Method Of Depreciation Calculation

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Depreciation Formula Calculate Depreciation Expense

Diminishing Value Vs The Prime Cost Method By Mortgage House

Depreciation Highbrow

Straight Line Vs Reducing Balance Depreciation Youtube

Depreciation Diminishing Value Method Youtube

Depreciation Formula Examples With Excel Template

Working From Home During Covid 19 Tax Deductions Guided Investor